Jun 30, 2024

Investment Notes: Aera

Jelix is proud to back Aera, the fintech platform simplifying and expediting the property journey for first home buyers - enabling them to save a 10% property deposit and get into their first property faster.

In June 2024, Jelix participated in Aera’s seed round led by New Zealand-based VC firm, Icehouse Ventures.

Why we're excited to back Aera

Huge and growing global market of first home buyers

Aera is targeting a large market of new first-home buyers struggling to save and purchase a property.

House prices throughout the Asia-Pacific region are soaring well beyond the growth rate of savings and income, creating a significant hurdle for first-home buyers. Buyers must swiftly save the requisite 10% down payment for the purchase, and then an amount equal to approximately 4-7% of the home's value for supplementary fees such as income insurance, mortgage brokers, and purchase commissions. For instance, on a $1 million home purchase, this translates to a hefty $40,000 - $70,000 in intermediary costs.

In New Zealand and Australia alone there is an an estimated 1.5 million first home savers, and 150,000 first home buyers entering the market each year. If Aera is able to support 5,000 first home buyers per year, they will generate $100m in revenue. In addition, Aera have highlighted Indonesia and India as adjacent markets with similar dynamics that will be ripe for disruption.

Innovative business model tackling a highly fragmented home-buying market

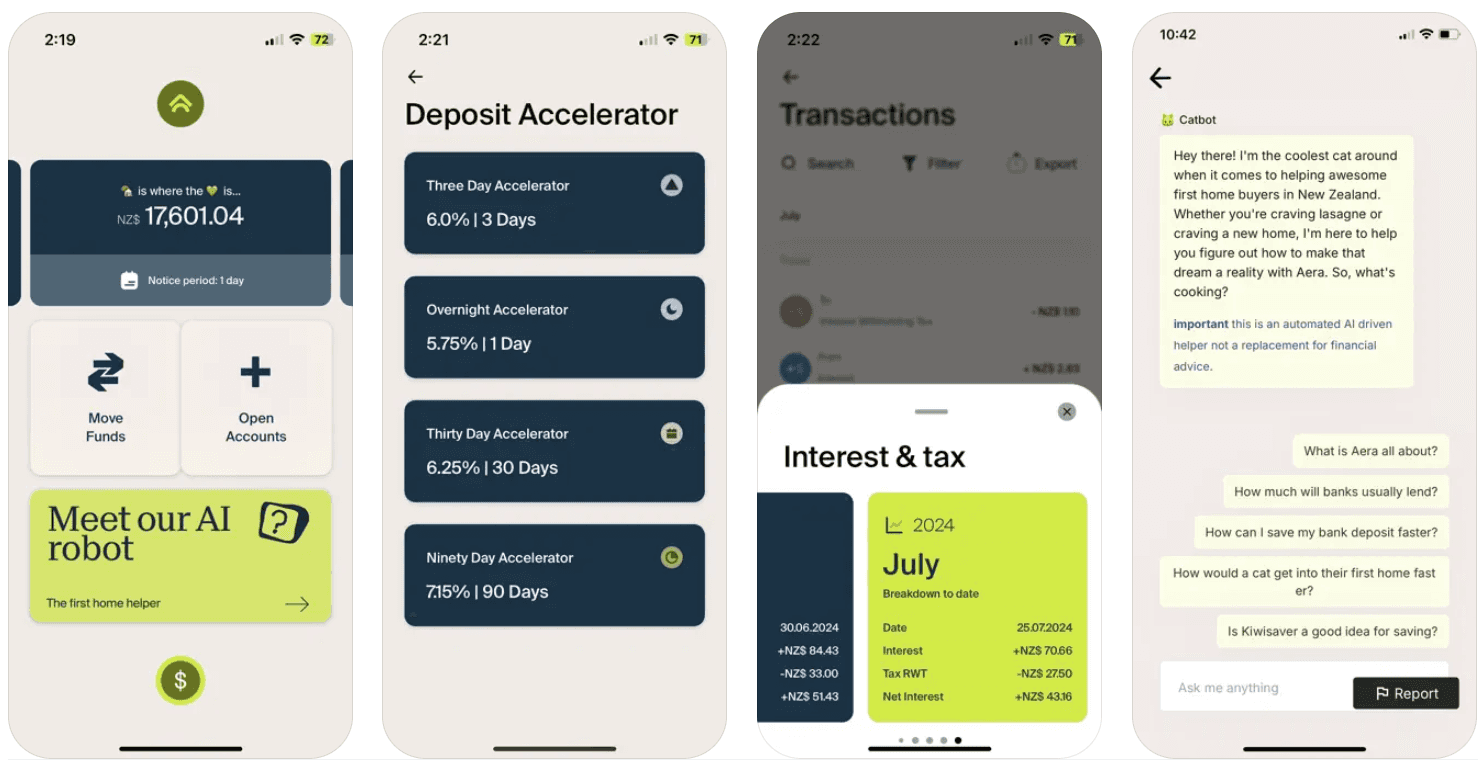

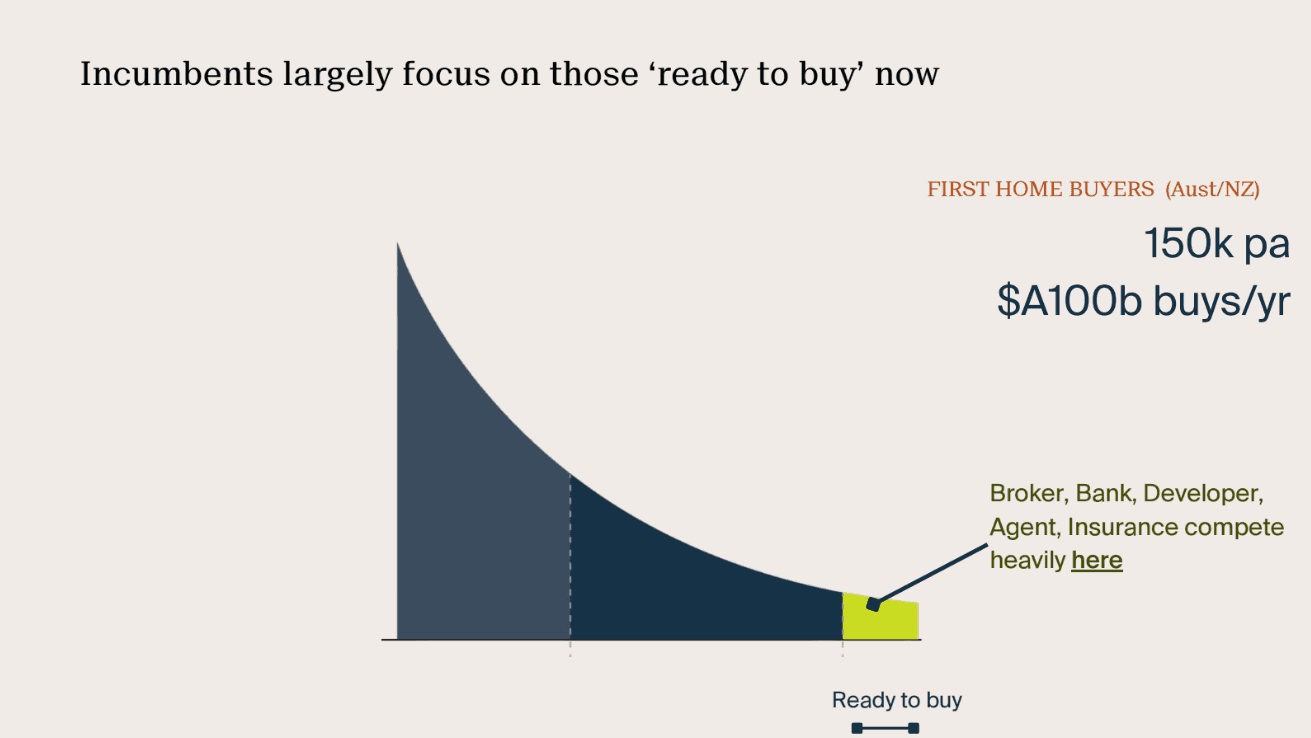

Aera’s mission is to expedite the journey of first-time home buyers by offering a unique, unified approach to the buying process which is currently fragmented across various industry players. Aera operates as a digital platform, attracting customers to invest in high-yield first-home saver accounts backed by fixed-income assets. Then Aera guides individuals towards their optimal path to purchase. While most industry players focus on the “ready to buy” segment which typically intends to purchase within 3 months, Aera is targeting the larger, longer tail of this market in buyers just starting out on their first-home saving journey.

As customers accumulate savings and transition into prospective buyers, Aera then offers a suite of services through its app, including mortgage broking and home insurance. To incentivise utilisation of its services (for which Aera receives a fee), Aera provides substantial cash-back credits that augment customers' down payments, thereby accelerating their journey towards homeownership. In a hypothetical scenario involving a $1 million house purchase, Aera estimates it could potentially refund $20,000 in cash-back credits while generating $20,000 in net revenue.

MoneyBox, a successful startup in the UK provides a similar model for incentivised savings.

Exciting and experienced founding team

This ambitious goal of disrupting a complex sector is a tall task. We are comforted by the calibre of the team taking on this mission. Co-founder and CEO Derek Handley is a serial entrepreneur and investor who has exited two business and raised a climate tech venture capital fund, Aera.VC.

Handley has teamed up with James Abbott as Co-founder and COO, who was the first hire of New Zealand based Buy Now, Pay Later leader ‘Laybuy’.

Supporting the team is seasoned chief executive and retail banking expert Andrew Thorburn, who joins as co-founder and strategic adviser. Thorburn brings a wealth of retail banking experience from his roles as former Group CEO of NAB and CEO of Bank of NZ.

The team's combination of skills and entrepreneurial acumen provides an exciting launchpad for this ambitious fintech.