Holistic media intelligence platform impressing large corporates

First Invested

First Invested

First Invested

Dec 1, 2021

Stage

Stage

Stage

Seed

Sector

Sector

Sector

Advertising & Media

Model

Model

Model

SaaS

Co investor

Co investor

Co investor

Investible

Uplift

Uplift

Uplift

1.0x (as at Jun 30 2024)

Founder

Founder

Founder

John Croll

Strong consistent growth following successful US market entry

Truescope offers comprehensive media monitoring subscription services covering all media sources in near real-time.

After successfully entering the US market in 2023, Truescope now generates >$11M in ARR and serving large corporate and government customers in New Zealand, Singapore, and the US.

Truescope has demonstrated consistently strong growth, achieving 110% growth year on year over 2 years with strong customer loyalty and high retention.

The investment story

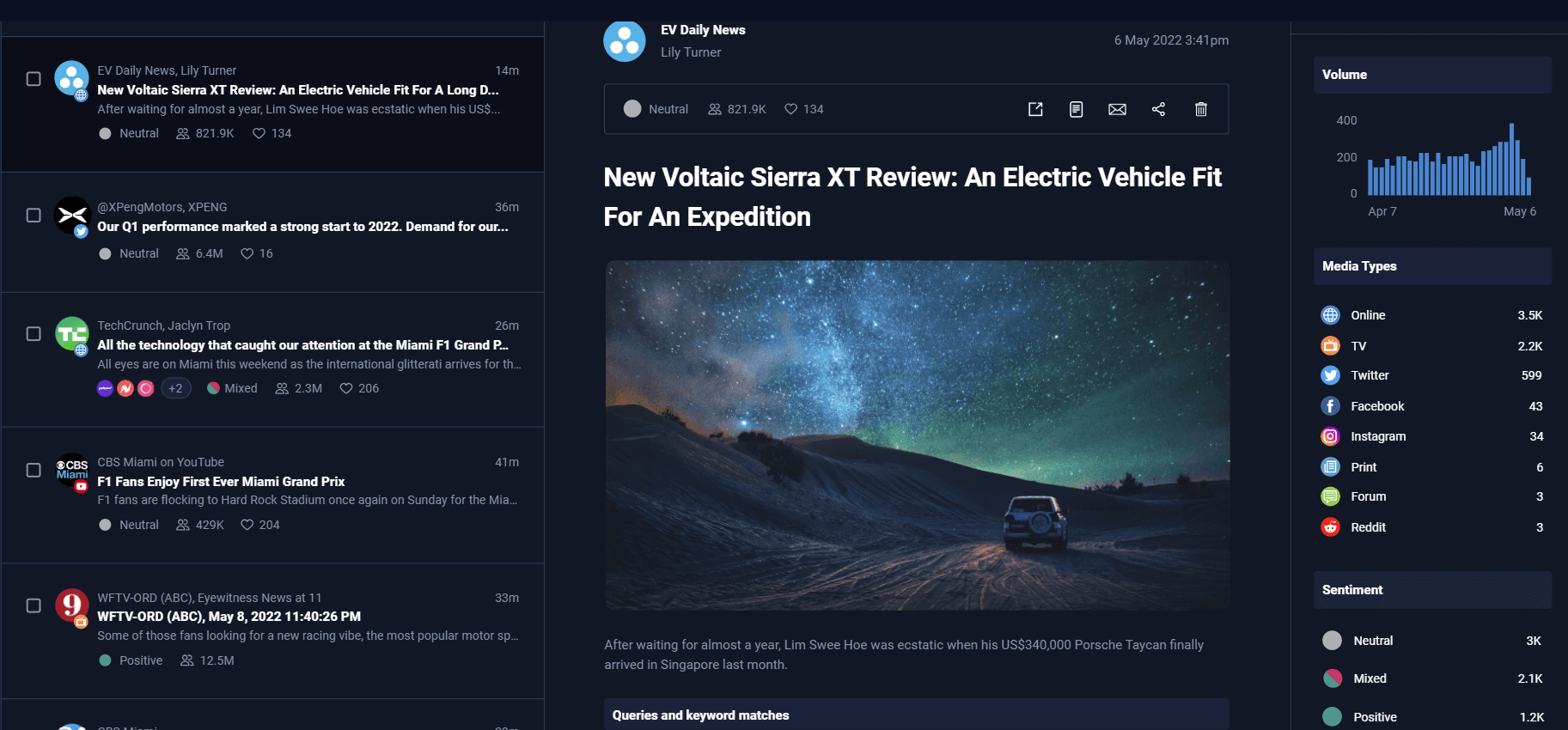

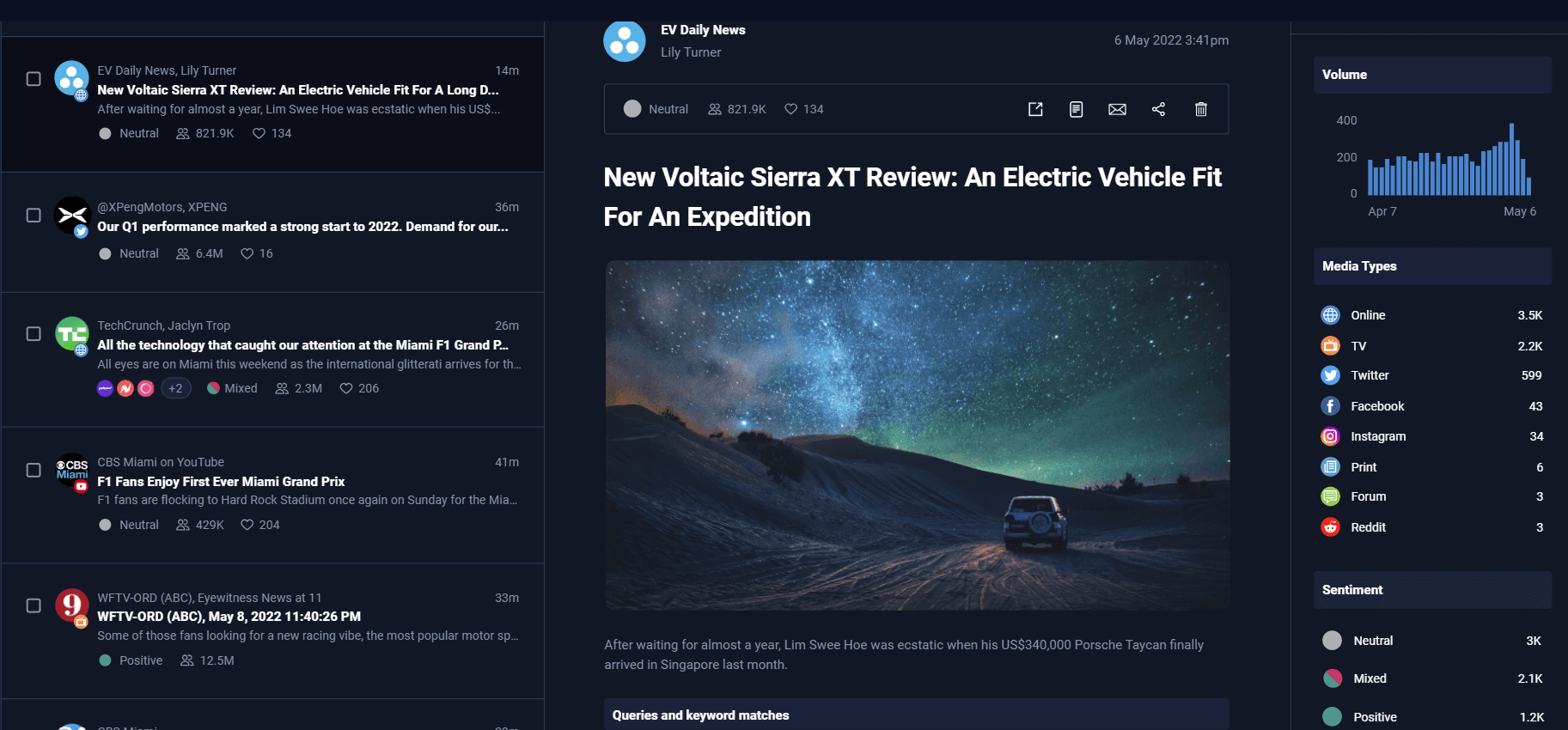

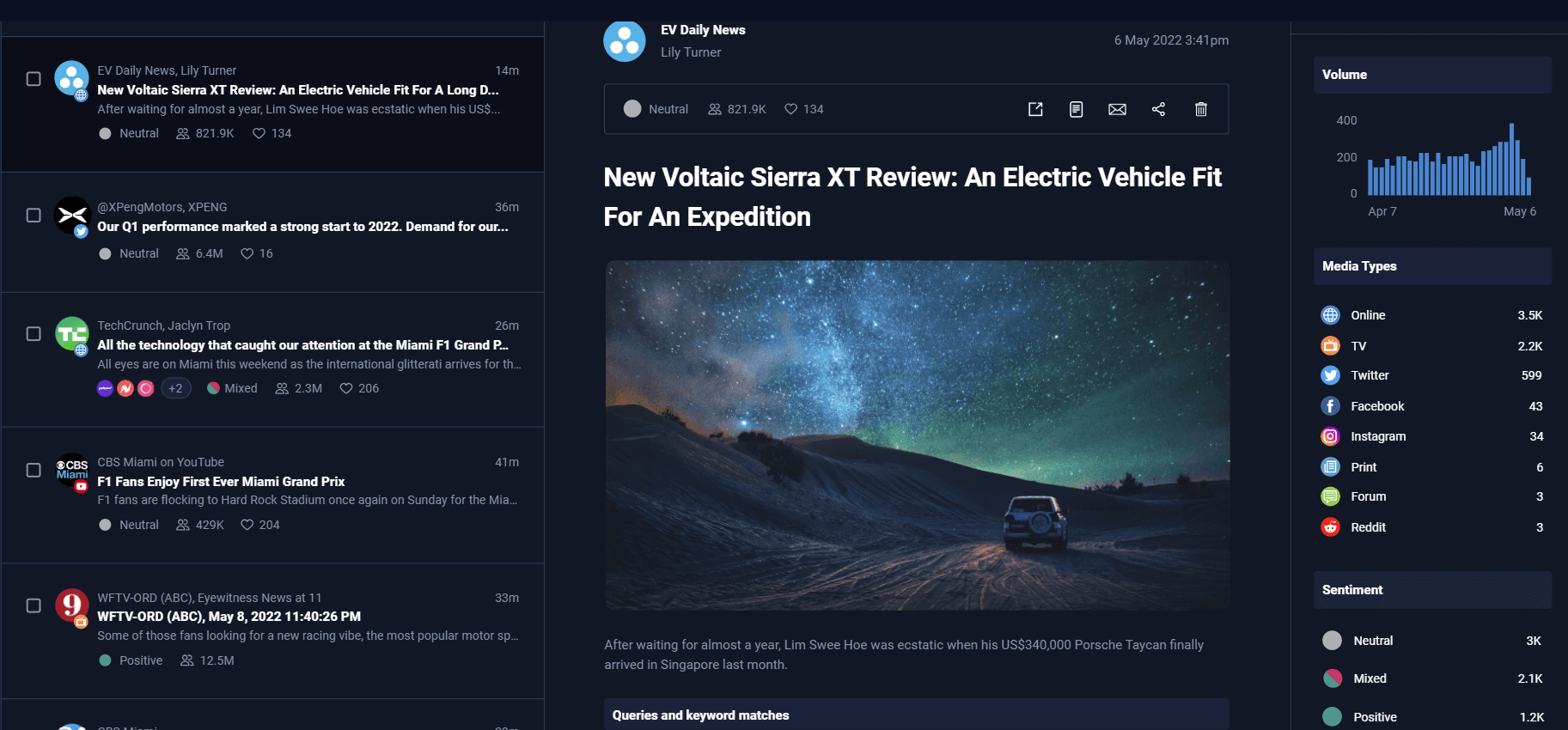

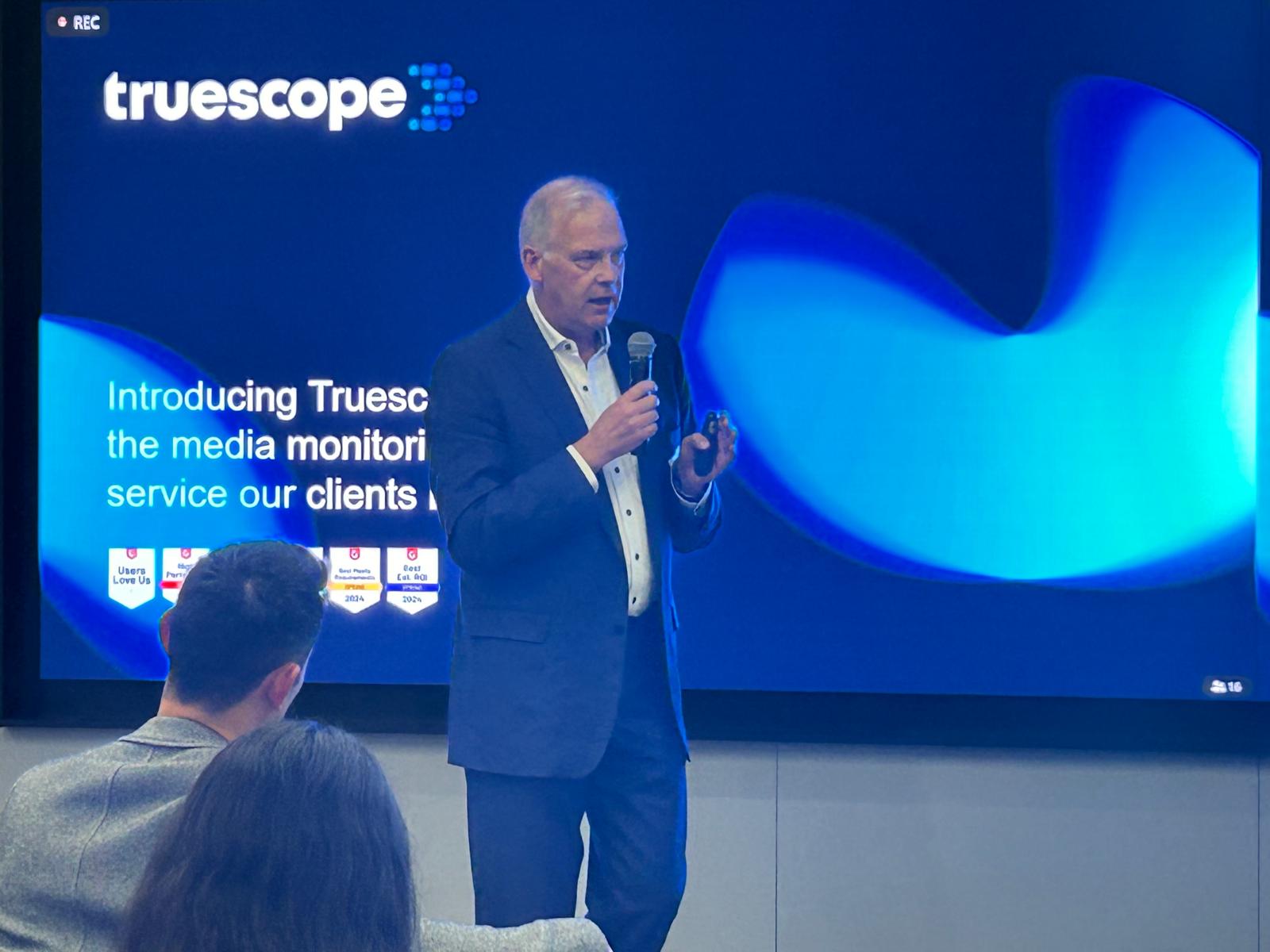

Truescope delivers integrated media intelligence by accessing, indexing and delivering comprehensive data from online sources, forums, social and mainstream media, in near real-time. Truescope then alerts companies to opportunities, breaking news, analysis & important industry stories. The media monitoring platform helps brands measure ROI of communications activities and make data-driven decisions.

Jelix first invested in Truescope in December 2021, having known founder John Croll since 2002. He is an exceptional founder with deep domain experience having grown competitor, Isentia (ASX: ISD).

Since then, Truescope has gained significant momentum and now serves large customers throughout the US, Singapore and New Zealand. It has an advantage over legacy software by offering a fully integrated product including all media sources, a user experience customers love, and a competitive price.

Truescope has demonstrated strong customer acquisition and retention ability, having now signed 62 customers and successfully expanded into the US market. The business continues to organically acquire large customers in the US and maintains strong customer loyalty and online ratings.

The results so far

Jelix first invested in Truescope during its Seed round in December 2021, the business had demonstrated encouraging signs of product market fit with established revenue from New Zealand and Singapore market traction. Truescope then successfully entered the US market in 2023 by acquiring local competitors and retaining >90% of customers. It has generated consistent customer loyalty and overwhelmingly positive customer reviews.

As of June 2024, Truescope is achieving ARR of $11.6M and 110% year on year growth over 2 years. The team has been quick to include AI-powered integrations within its product suite and has its sights on new markets while furthering its reach with the US.

We are incredibly proud to be supporting the Truescope journey.

The investment story

Truescope delivers integrated media intelligence by accessing, indexing and delivering comprehensive data from online sources, forums, social and mainstream media, in near real-time. Truescope then alerts companies to opportunities, breaking news, analysis & important industry stories. The media monitoring platform helps brands measure ROI of communications activities and make data-driven decisions.

Jelix first invested in Truescope in December 2021, having known founder John Croll since 2002. He is an exceptional founder with deep domain experience having grown competitor, Isentia (ASX: ISD).

Since then, Truescope has gained significant momentum and now serves large customers throughout the US, Singapore and New Zealand. It has an advantage over legacy software by offering a fully integrated product including all media sources, a user experience customers love, and a competitive price.

Truescope has demonstrated strong customer acquisition and retention ability, having now signed 62 customers and successfully expanded into the US market. The business continues to organically acquire large customers in the US and maintains strong customer loyalty and online ratings.

The results so far

Jelix first invested in Truescope during its Seed round in December 2021, the business had demonstrated encouraging signs of product market fit with established revenue from New Zealand and Singapore market traction. Truescope then successfully entered the US market in 2023 by acquiring local competitors and retaining >90% of customers. It has generated consistent customer loyalty and overwhelmingly positive customer reviews.

As of June 2024, Truescope is achieving ARR of $11.6M and 110% year on year growth over 2 years. The team has been quick to include AI-powered integrations within its product suite and has its sights on new markets while furthering its reach with the US.

We are incredibly proud to be supporting the Truescope journey.

The investment story

Truescope delivers integrated media intelligence by accessing, indexing and delivering comprehensive data from online sources, forums, social and mainstream media, in near real-time. Truescope then alerts companies to opportunities, breaking news, analysis & important industry stories. The media monitoring platform helps brands measure ROI of communications activities and make data-driven decisions.

Jelix first invested in Truescope in December 2021, having known founder John Croll since 2002. He is an exceptional founder with deep domain experience having grown competitor, Isentia (ASX: ISD).

Since then, Truescope has gained significant momentum and now serves large customers throughout the US, Singapore and New Zealand. It has an advantage over legacy software by offering a fully integrated product including all media sources, a user experience customers love, and a competitive price.

Truescope has demonstrated strong customer acquisition and retention ability, having now signed 62 customers and successfully expanded into the US market. The business continues to organically acquire large customers in the US and maintains strong customer loyalty and online ratings.

The results so far

Jelix first invested in Truescope during its Seed round in December 2021, the business had demonstrated encouraging signs of product market fit with established revenue from New Zealand and Singapore market traction. Truescope then successfully entered the US market in 2023 by acquiring local competitors and retaining >90% of customers. It has generated consistent customer loyalty and overwhelmingly positive customer reviews.

As of June 2024, Truescope is achieving ARR of $11.6M and 110% year on year growth over 2 years. The team has been quick to include AI-powered integrations within its product suite and has its sights on new markets while furthering its reach with the US.

We are incredibly proud to be supporting the Truescope journey.

Why Jelix believes in Truescope

John Croll is an exceptional founder whom Jelix has known since 2002. He has deep domain expertise having grown Isentia (ASX: ISD) over many years, which he left to build a better alternative. He has built a highly experienced management team to facilitate growth.

Demonstrated consistent traction: since signing the first client in 2020, Truescope has signed 62 clients, with a conversion rate of 68%. The company now generates >$11M in ARR.

Large growing global market driven by demand for analytics to measure impact and ROI of communication.

Why Jelix believes in Truescope

John Croll is an exceptional founder whom Jelix has known since 2002. He has deep domain expertise having grown Isentia (ASX: ISD) over many years, which he left to build a better alternative. He has built a highly experienced management team to facilitate growth.

Demonstrated consistent traction: since signing the first client in 2020, Truescope has signed 62 clients, with a conversion rate of 68%. The company now generates >$11M in ARR.

Large growing global market driven by demand for analytics to measure impact and ROI of communication.

Why Jelix believes in Truescope

John Croll is an exceptional founder whom Jelix has known since 2002. He has deep domain expertise having grown Isentia (ASX: ISD) over many years, which he left to build a better alternative. He has built a highly experienced management team to facilitate growth.

Demonstrated consistent traction: since signing the first client in 2020, Truescope has signed 62 clients, with a conversion rate of 68%. The company now generates >$11M in ARR.

Large growing global market driven by demand for analytics to measure impact and ROI of communication.

“Andrea and Ian partnered with Truescope from the first meeting. They provided thoughtful advice, introduced us to a great network and are always looking for opportunities. The startup community in Australia respects the Jelix name and their involvement with Truescope is positive on so many levels.”

Mickael Roger

Co-founder & CEO, PropHero

Register for investment opportunities

For Founders

What we look for, where we invest and how our investment process works.

For Founders

What we look for, where we invest and how our investment process works.

For Founders

What we look for, where we invest and how our investment process works.

Be the first to hear about Jelix news and events

By signing up to receive emails from Jelix Ventures, you agree to our Privacy Policy. We treat your info responsibly.

Jelix Ventures

© 2024 All Right Reserved by Jelix Ventures.

Jelix acknowledges the Gadigal people of the Eora Nation as the Traditional Custodians of the Country we work and live on, and recognise their continuing connection to the land and waters. We pay our respects to Elders past, present, and emerging, and extend that respect to all First Nations people.

Jelix Ventures Management Company Pty Ltd (ABN 60 613 582 773) is a Corporate Authorised Representative (No. 001281193) of Shell Cove Capital Management Ltd (ACN 107 290 335) Australian Financial Licence No 247143. Any advice provided by Jelix is without taking account of your objectives, financial situation and needs. Jelix is authorised to provide financial services to wholesale or sophisticated investors only. Potential investors should do their own due diligence and make their own investment decisions, consulting with licensed legal professionals and investment advisors for legal, tax, insurance, or investment advice. Jelix Ventures Management Company Pty Ltd (CAR of AFS Licence No 247143) and related entities and each of their respective directors, officers and agents ("Jelix") believe that the information contained in this page and its attachments have been obtained from reliable sources and that any estimates, opinions, conclusions or recommendations are reasonably held at the time of compilation. No warranty is made as to the accuracy of the information in this page and, to the maximum extent permitted by law, Jelix disclaims all liability for any loss or damage which may be suffered by any recipient through relying on anything contained or omitted from this page. Jelix does not warrant the attached files are free from computer viruses or other defects and is provided on the basis that the user assumes all responsibility for any loss, damage or consequence resulting from use.

Be the first to hear about Jelix news and events

By signing up to receive emails from Jelix Ventures, you agree to our Privacy Policy. We treat your info responsibly.

Jelix Ventures

© 2024 All Right Reserved by Jelix Ventures.

Jelix acknowledges the Gadigal people of the Eora Nation as the Traditional Custodians of the Country we work and live on, and recognise their continuing connection to the land and waters. We pay our respects to Elders past, present, and emerging, and extend that respect to all First Nations people.

Jelix Ventures Management Company Pty Ltd (ABN 60 613 582 773) is a Corporate Authorised Representative (No. 001281193) of Shell Cove Capital Management Ltd (ACN 107 290 335) Australian Financial Licence No 247143. Any advice provided by Jelix is without taking account of your objectives, financial situation and needs. Jelix is authorised to provide financial services to wholesale or sophisticated investors only. Potential investors should do their own due diligence and make their own investment decisions, consulting with licensed legal professionals and investment advisors for legal, tax, insurance, or investment advice. Jelix Ventures Management Company Pty Ltd (CAR of AFS Licence No 247143) and related entities and each of their respective directors, officers and agents ("Jelix") believe that the information contained in this page and its attachments have been obtained from reliable sources and that any estimates, opinions, conclusions or recommendations are reasonably held at the time of compilation. No warranty is made as to the accuracy of the information in this page and, to the maximum extent permitted by law, Jelix disclaims all liability for any loss or damage which may be suffered by any recipient through relying on anything contained or omitted from this page. Jelix does not warrant the attached files are free from computer viruses or other defects and is provided on the basis that the user assumes all responsibility for any loss, damage or consequence resulting from use.

Be the first to hear about Jelix news and events

By signing up to receive emails from Jelix Ventures, you agree to our Privacy Policy. We treat your info responsibly.

Jelix Ventures

© 2024 All Right Reserved by Jelix Ventures.

Jelix acknowledges the Gadigal people of the Eora Nation as the Traditional Custodians of the Country we work and live on, and recognise their continuing connection to the land and waters. We pay our respects to Elders past, present, and emerging, and extend that respect to all First Nations people.

Jelix Ventures Management Company Pty Ltd (ABN 60 613 582 773) is a Corporate Authorised Representative (No. 001281193) of Shell Cove Capital Management Ltd (ACN 107 290 335) Australian Financial Licence No 247143. Any advice provided by Jelix is without taking account of your objectives, financial situation and needs. Jelix is authorised to provide financial services to wholesale or sophisticated investors only. Potential investors should do their own due diligence and make their own investment decisions, consulting with licensed legal professionals and investment advisors for legal, tax, insurance, or investment advice. Jelix Ventures Management Company Pty Ltd (CAR of AFS Licence No 247143) and related entities and each of their respective directors, officers and agents ("Jelix") believe that the information contained in this page and its attachments have been obtained from reliable sources and that any estimates, opinions, conclusions or recommendations are reasonably held at the time of compilation. No warranty is made as to the accuracy of the information in this page and, to the maximum extent permitted by law, Jelix disclaims all liability for any loss or damage which may be suffered by any recipient through relying on anything contained or omitted from this page. Jelix does not warrant the attached files are free from computer viruses or other defects and is provided on the basis that the user assumes all responsibility for any loss, damage or consequence resulting from use.